41 is yield to maturity the same as coupon rate

Is the yield to maturity on a bond the same thing as the ... Correct answers: 2 question: Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percen. Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

fin 300 Flashcards - Quizlet Bond J has a coupon rate of 4 percent. Bond S has a coupon rate of 14 percent. Both bonds have 10 years to maturity, make semiannual payments, and have a YTM of 8 percent.

Is yield to maturity the same as coupon rate

Is the Yield to Maturity on a Bond the Same Thing As the ... If you paid $1,000 for the bond, your yield is 5 percent — the same as the coupon rate. If you paid $990.57 for the bond, your yield is 6 percent — you get the same $1,050 back, but it now represents a 6 percent return on your initial investment. If you paid $1,009.62 for the bond, your yield falls to 4 percent. Yield To Maturity: What It Is And Why It's Important At that point, the yield to maturity is simply the coupon rate. However, this is rarely the case. Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR(Internal Rate of Return) on any investment. It is a calculation measuring the cash flows starting with the purchase ... What is the relationship between YTM and the discount rate ... The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters.

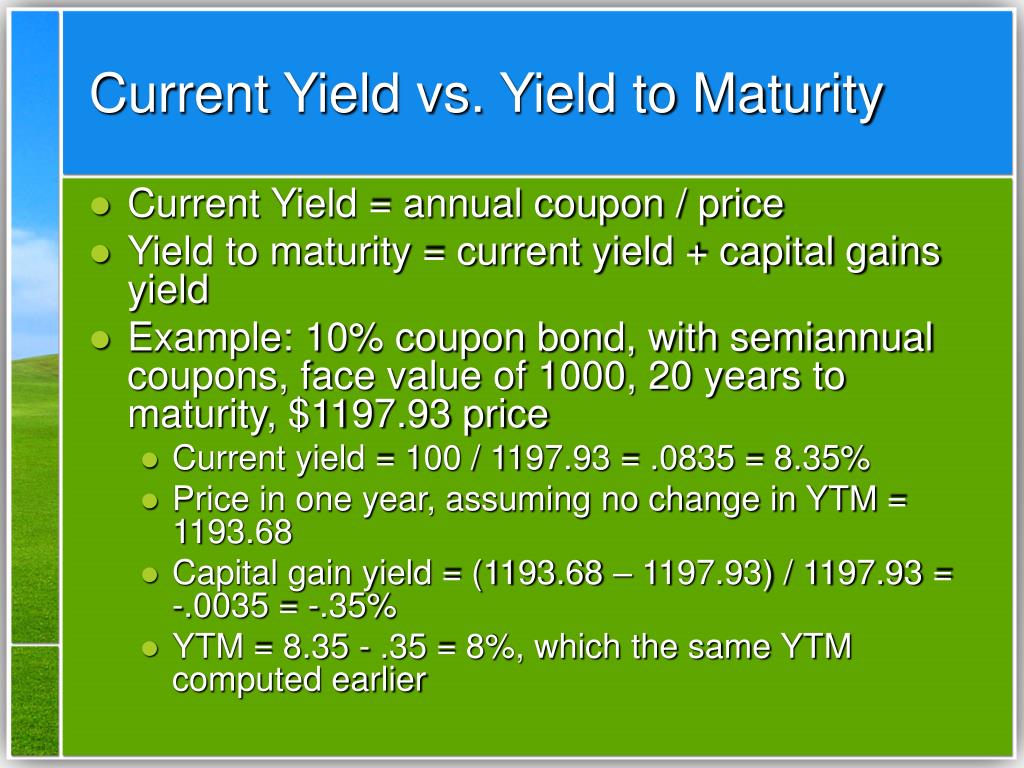

Is yield to maturity the same as coupon rate. Difference Between Coupon Rate and Yield to Maturity (With ... The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver. Coupon rate - lifebytetech.com.my The current yield could differ from the coupon rate, depending on the worth at which an investor buys a bond. For instance, if an investor pays less than the face amount of a bond, the present yield is greater than the coupon rate. Conversely, if the investor pays greater than the face quantity, the current yield is decrease than the coupon rate. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Difference Between Yield to Maturity and Coupon Rate ... The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS. 1. Solved Yield to maturity 5 Multiple Choice 2.38 points ... O. Question: Yield to maturity 5 Multiple Choice 2.38 points Skipped is equal to the coupon rate if the bond is held to maturity O is the same as the coupon rate. will exceed the coupon rate if the bond is purchased for face value. is the same as the coupon rate if the bond is purchased for face value and held to maturity. O. Solved Is the yield to maturity on a bond the same thing ... This problem has been solved! Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. The Difference Between Interest Rate & Yield to Maturity ... If, however, the company's stock price doubles, but the dividend remains the same, the yield equals 2 percent. Example of Bond Yield A bond's yield is termed yield-to-maturity, or YTM. The YTM equals the return a bondholder will receive after the bond matures. The basis of that yield is the interest rate the bond issuer agrees to pay.

Bond Yield Rate vs. Coupon Rate: What's the Difference? If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. 1 When discussing bonds, it is important to note the many different... Yield to Maturity (YTM) Definition & Example ... The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Difference Between Yield to Maturity and Discount Rate ... The main difference between Yield to Maturity and Discount Rate is that Yield to maturity is to give the total value for the bond return. But the discount rate is for finding the interest rates for the loans that are taken by us from the banks. Calculating yield to maturity is a very difficult and complicated process. Yield to maturity - Wikipedia Yield to put (YTP): same as yield to call, but when the bond holder has the option to sell the bond back to the issuer at a fixed price on specified date. Yield to worst (YTW): when a bond is callable, puttable, exchangeable, or has other features, the yield to worst is the lowest yield of yield to maturity, yield to call, yield to put, and others.

Yield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

Is Bond yield the same as yield to maturity? Yield to maturity is similar to current yield, which divides annual cash inflows from a bond by the market price of that bond to determine how much money one would make by buying a bond and holding it for one year. Yet, unlike current yield, YTM accounts for the present value of a bond's future coupon payments. Click to see full answer.

What is the difference between discount rate and yield? What is the difference between coupon rate and yield to maturity? The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment which is held till the maturity date and the rate of return it will generate at the maturity date.

Answered: Laurel, Inc., has debt outstanding with… | bartleby Laurel, Inc., has debt outstanding with a coupon rate of 6.0% and a yield to maturity of 7.0%. Its tax rate is 35%. What is Laurel's effective (after-tax) cost of debt? NOTE: Assume that the debt has annual coupons. Note: Assume that the firm will always be able to utilize its full interest tax shield.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

[Solved] Bond Coupon rate Maturity Current price Yield to maturity ABC 6.50% 31 December 2022 ...

Is the yield to maturity on a bond the same thing as the ... The yield to maturity is simply the required rate of return on a bond. They are typically used interchangeably. Furthermore, the YTM is not the same thing as the coupon rate. YTM is the percentage rate of return while the coupon rate is the annual amount of interest that the bond owner will receive.

[Solved] Bond Coupon rate Maturity Current price Yield to maturity ABC 6.50% 31 December 2022 ...

Coupon Rate - Meaning, Calculation and Importance Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond.

[Solved] The spot exchange rate is $1.80 = 1.00. The dollar-based yield to maturity is i$ = 3% ...

[Bonds] What is the difference between yield to maturity ... So, as I understand it, the yield to maturity is basically the annual return, which is basically the same as its interest rate. I wanted to know how much this bond etf would return annually. Its yield to maturity is 1.84% and average coupon is 3.13%. I don't understand how this can be.

SOLVED:Suppose a five-year, bond with annual coupons has a ... Involve zero-coupon bonds. A zero-coupon bond is a bond that is sold now at a discount and will pay its face value at the time when it matures; no interest payments are made. If Pat pays $\$ 12,485.52$ for a $\$ 25,000$ face-value, zero-coupon bond that matures in 8 years, what is his annual rate of return?

What is the yield to maturity » Full Grade Assignment ID: FG133128123 . Consider a 10-year bond that makes semiannual coupon payments. If the face value is 100, the coupon rate is 2% and the bond price is 84.867, what is the yield to maturity (percentage point, continuously compounded, round to second decimal place)?

The Relationship Between Yield to Maturity and Internal ... A closer look at yield to maturity and internal rate of return reveals that in the case of fixed-income investments, they are one and the same. ... and a 6 percent coupon rate would pay you $60 ...

Difference Between Yield to Maturity and Coupon Rate | Yield to Maturity vs Coupon Rate

Is Bond Yield-to-Maturity and Bond market-interest-rate ... The Yield to Maturity will be higher. Let's say you pay $950 for a $1000 bond; it matures in 5 years with a 7% Coupon. It will pay you $70 interest per year for 5 years. Plus, in 5 years, it will pay you $1000. That will give you a $50 profit. All told, you will earn $400 on a $950 investment. That's a Yield to Maturity of 8.24%

What’s the Difference Between Premium Bonds and Discount Bonds? - Relationship between yield to ...

What is the relationship between YTM and the discount rate ... The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters.

You purchased a zero-coupon bond one year ago for $281.83. The market interest rate is now 9 ...

Yield To Maturity: What It Is And Why It's Important At that point, the yield to maturity is simply the coupon rate. However, this is rarely the case. Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR(Internal Rate of Return) on any investment. It is a calculation measuring the cash flows starting with the purchase ...

Is the Yield to Maturity on a Bond the Same Thing As the ... If you paid $1,000 for the bond, your yield is 5 percent — the same as the coupon rate. If you paid $990.57 for the bond, your yield is 6 percent — you get the same $1,050 back, but it now represents a 6 percent return on your initial investment. If you paid $1,009.62 for the bond, your yield falls to 4 percent.

Post a Comment for "41 is yield to maturity the same as coupon rate"