45 are treasury bills zero coupon bonds

› ask › answersHow Are Corporate Bonds Taxed? - Investopedia Jun 14, 2021 · When this happens, such as the purchase of a zero coupon bond, the difference between the par value and initial offer price is known as the original issue discount, and it is subject to taxes ... Castle Shannon Becomes First Police Department in ... Truleo, the leading provider of automated body camera review and analysis technology for law enforcement, today announced that Castle Shannon Police Department is the first agency in Pennsylvania ...

Vanguard Bond ETF List - ETFdb.com Vanguard Bond ETF List. Vanguard Bond ETFs are funds that track various fixed-income sectors and segments of the global bond market. These can include various duration lengths, credit qualities and bond types, such as TIPS, MBS, munis and corporate bonds. Additionally, they can cover international and domestic bonds.

Are treasury bills zero coupon bonds

The Differentiated Appeal Of EM Debt - BlackRock ... Sources: BlackRock Investment Institute, with data from Refinitiv, April 2022. Notes: The chart shows the total returns for emerging market local-currency bonds compared with U.S. Treasury bonds based on the JP Morgan GBI-EM Global Diversified and regional (LatAm and Europe) indexes and Bloomberg U.S. Treasury USD index. Watch 'Bloomberg Daybreak: Asia' Full Show (04/29/2022 ... Now we continue to see the Treasury markets a little bit mixed at the moment. ... is being hit hard by the zero Covid policy the outbreak trying to get off a crime under control. ... bill to bring ... Repricing A Market Priced For Zero | Seeking Alpha Because Treasury bonds include a face-value payment at maturity, the impact of rising rates has been even more severe for long-term bonds. Indeed, 30-year Treasury bonds have lost about one-third ...

Are treasury bills zero coupon bonds. Thailand Government Bonds - Yields Curve Thailand Government Bonds - Yields Curve. Last Update: 24 Apr 2022 14:15 GMT+0. The Thailand 10Y Government Bond has a 2.790% yield. 10 Years vs 2 Years bond spread is 138.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.50% (last modification in May 2020). The Thailand credit rating is BBB+, according to ... Netherlands Government Bonds - Yields Curve The Netherlands 10Y Government Bond has a 1.079% yield. 10 Years vs 2 Years bond spread is 84.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016). The Netherlands credit rating is AAA, according to Standard & Poor's agency. 1.00% May-38 Bund - Bonds & Currency News | Market News Yields on the 0% May-36 Bund have been in positive terriotory throughout this year and had rose from close to 0% to 0.40% by mid-February before falling back to close to 0% at the beginning of the Ukraine war and have since moved at high at 1.086% over the past 10 days, and at the time of writing yields are around 0.97%. Government Debt Management - Treasury Bills (RIKV 22 0622 ... NASDAQ Iceland hf. Bond Market information Government Debt Management - Treasury Bills (RIKV 22 0622) admitted to trading on April 27, 2022 Issuer Information 1 Issuer: Endurlán ríkissjóðs 2 Org. no: 471283-0459 3 LEI 254900IPCJWRC6XAJN15 Issue Information 4 Symbol (Ticker) RIKV 22 0622 5 ISIN code IS0000034015 6 CFI code D-Y-Z-T-X-R 7 FISN númer ENDURLAN RIKIS/ZERO CPN TB 20220622 8 ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Disadvantages of Zero-coupon Bonds. There are two major disadvantages of zero-coupon bonds. The first disadvantage is they do not throw off any income as the capital is stored in the bond. In some countries the imputed interest may be taxed as income even though the bond has not yet been redeemed or reached maturity. › market-data › bondsBonds & Rates - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Bonds You Can Build On | PIMCO Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations ... U.S. Treasury Bond Overview - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures.

Ares Capital Corporation Announces March 31, 2022 ... NEW YORK, April 26, 2022--Ares Capital Corporation ("Ares Capital") (NASDAQ: ARCC) announced that its Board of Directors has declared a second quarter dividend of $0.42 per share. The second ... investorjunkie.com › bonds-fixed-income-cds › how-toInvesting in Treasury Bills: The Safest Investment in 2022 May 30, 2021 · Interest rates across the developed world have fallen in unison to practically zero. In some countries, bonds even have negative yields — an idea that two decades ago was considered impossible! With rates so low, investors of U.S Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds) barely get any yield at all. Pakistan Government Bonds - Yields Curve Pakistan Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. Investment Maturity Investment result LiveLive Market Watch - Bonds Trade In Capital ... - NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest, if any. YTM computation is based on the Corporate Action dates available with the Exchange. Download the example for understanding of yield calculation. Disclaimer: The information and content (collectively 'information') provided herein are provided by NSE as ...

T-Bill,G-Sec,Zero Coupon Bonds,Bearer Bonds,Cash Management Bills,Call Money, Certificate of ...

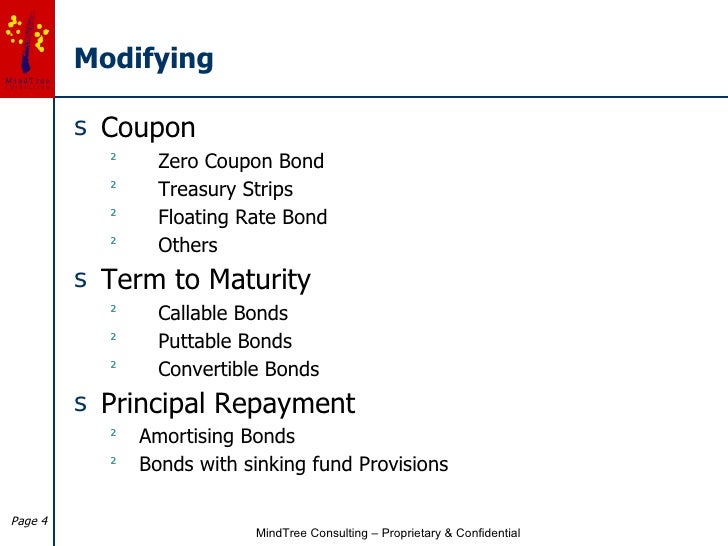

Fin331 week 4 homework 2017 - Pay 4 Essay The terms of a bond allows its issuer to redeem the security at anytime. This type of bond is _____. Question 4 options: an Asian callable. an American callable. a Bermudan callable. a European callable. Question 5 (1 point) A company issues a bond with a coupon rate of 5%. Since the bond was issued, market interest rates have decreased.

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 1.978% yield. 10 Years vs 2 Years bond spread is 26 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.75% (last modification in March 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Ponzi corporation has bonds on the market with 14.5 years ... Zero Coupon Bonds. Suppose your company needs to raise $45 million and you want to issue 30-year bonds for this purpose. Assume the required return on your bond issue will be 6 percent, and you're evaluating two issue alternatives: a 6 percent semiannual coupon bond and a zero coupon bond. Your company's tax rate is 35 percent. a.

How And How Not To Hedge Inflation | Seeking Alpha there are some downsides too: 1) you can only buy a small amount - $10k electronically and another $5k via your federal taxes per calendar year (presumably you can double this up with your...

France Government Bonds - Yields Curve The France 10Y Government Bond has a 0.728% yield. 10 Years vs 2 Years bond spread is 101.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016). The France credit rating is AA, according to Standard & Poor's agency.

One Hundred Dollar Bill And US Treasury Savings Bond Stock Illustration - Illustration of loan ...

Grant's | Almost Daily Grant's What's more, Kuroda unleashed full-scale yield curve control to keep benchmark rates at lawn level, pledging to purchase an unlimited sum of 10-year Japanese Government Bonds at a 25 basis point yield in service of that goal (headline CPI advanced by 1.2% year-over-year in March, the highest reading since fall 2018).

ccilindia.com - Market Rates Government of Maharashtra has declared February 7, 2022 as a public holiday under Section 25 of Negotiable Instruments act , 1981. There will be no transaction in Government Securities, Forex and Money Markets.

Foreign Investors Bought Just Over Half of All Russia's OFZ Bonds Issued in Q1 2019 - The Moscow ...

Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 03/13/2022. AAA RATED MUNI BONDS AA RATED MUNI BONDS

Treasury Rates, Interest Rates, Yields - Barchart.com Treasury bills (or T-Bills) mature in one year or less. Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least risky investment available to U.S. investors. Treasury notes (or T-Notes) mature in one ...

› terms › tTreasury Yield Definition Dec 31, 2021 · Yield on Treasury Bills . While Treasury notes and bonds offer coupon payments to bondholders, the T-bill is similar to a zero-coupon bond that has no interest payments but is issued at a discount ...

Bond Purchase Agreement dated April 27, 2022 between TNMP ... Bond Purchase Agreement dated April 27, 2022 between TNMP and the purchasers named therein ($65,000,000 of 4.13% First Mortgage Bonds due 2052, Series 2022A, $95,000,000 of 3.81% First Mortgage Bonds due 2032, Series 2022C) from PNM Resources filed with the Securities and Exchange Commission.

Repricing A Market Priced For Zero | Seeking Alpha Because Treasury bonds include a face-value payment at maturity, the impact of rising rates has been even more severe for long-term bonds. Indeed, 30-year Treasury bonds have lost about one-third ...

Watch 'Bloomberg Daybreak: Asia' Full Show (04/29/2022 ... Now we continue to see the Treasury markets a little bit mixed at the moment. ... is being hit hard by the zero Covid policy the outbreak trying to get off a crime under control. ... bill to bring ...

The Differentiated Appeal Of EM Debt - BlackRock ... Sources: BlackRock Investment Institute, with data from Refinitiv, April 2022. Notes: The chart shows the total returns for emerging market local-currency bonds compared with U.S. Treasury bonds based on the JP Morgan GBI-EM Global Diversified and regional (LatAm and Europe) indexes and Bloomberg U.S. Treasury USD index.

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

Post a Comment for "45 are treasury bills zero coupon bonds"