38 price of coupon bond

Coupon Bond Formula | Examples with Excel Template Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16. Coupon Bond = $1,033. Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). A bond with a coupon rate of 5%, has a face value of $100. The market ... We will write a custom Essay on A bond with a coupon rate of 5%, has a face value of $100.The market price of a bond currently… specifically for you for only $16.05 $13/page 805 certified writers online

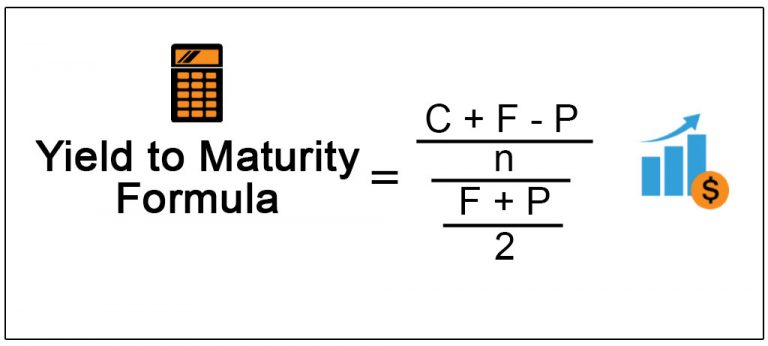

Coupon Rate Calculator | Bond Coupon For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Price of coupon bond

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Bond Coupon Interest Rate: How It Affects Price - Investopedia A $1,000 bond has a face value of $1,000. If its coupon rate is 1%, that means it pays $10 (1% of $1,000) a year. Coupon rates are largely influenced by prevailing national government-controlled... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

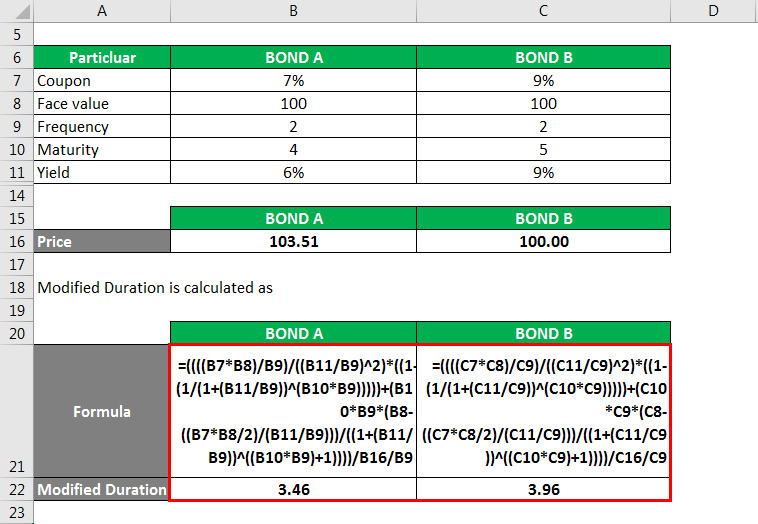

Price of coupon bond. How to calculate bond price in Excel? - ExtendOffice Sometimes, bondholders can get coupons twice in a year from a bond. In this condition, you can calculate the price of the semi-annual coupon bond as follows: Select the cell you will place the calculated price at, type the formula =PV (B20/2,B22,B19*B23/2,B19), and press the Enter key. The Zero Coupon Bond: Pricing and Charactertistics This means if we pay something around $72 (100-28) on December 1, 1996 for the $100 coupon due on December 1, 2001, we will earn something around 30% over the period or 6% a year. Pulling out our trusty bond calculator, we can actually do the calculation. At a semi-annual yield of 5.6%, the price works out to be $75.91. Coupon Bond | Coupon Bond Price | Examples of Coupon Bond Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Bond pricing - Bogleheads The formula is used consistently with coupon bearing bonds: Required yield = (annual rate/2), a semiannual compounding period (N*2). Bond price quotations. Bond prices are quoted using a percentage of par value. Price quotes less than 100 are selling at a discount; Price quotes equal to 100 are selling at par value

Calculate Price of Bond using Spot Rates | CFA Level 1 - AnalystPrep Sometimes, these are also called "zero rates" and bond price or value is referred to as the "no-arbitrage value." Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ... Zero-Coupon Bond: Formula and Excel Calculator The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Zero-Coupon Bond Yield Example Calculation In our next section, we'll work backward to calculate the yield-to-maturity (YTM) using the same assumptions as before. Model Assumptions Bond Price Calculator - Present Value of Future Cashflows - DQYDJ F = Face value of the bond r = Coupon rate PY = Payments a Year E = Days elapsed since last payment TP = Time between payments (from above description). Using the example in the calculator, but with 45 days elapsed: 1000 * (.1/2) * (45/180) = $12.50 The Dirty Price and Clean Price Formulas BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and ...

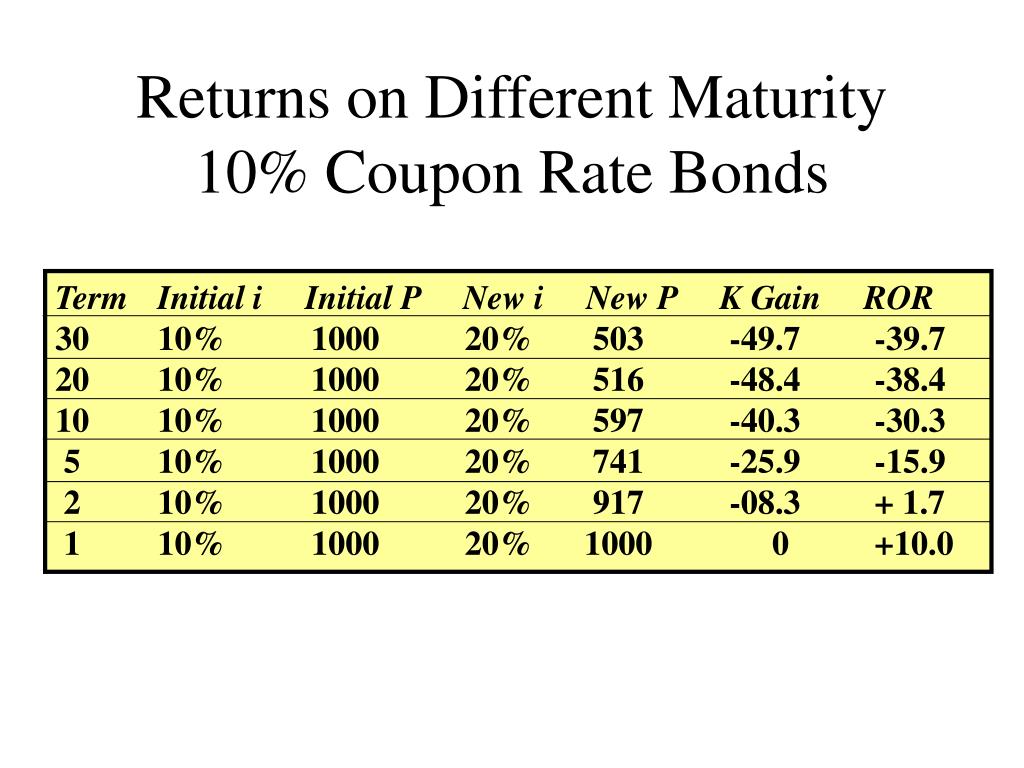

If Interest Rates Rise, What Happens to Bond Prices? Bond yield = Annual coupon payment / Bond price. Hence, if bond prices change, so do bond rates, and thus, yields. For example, suppose you have a $500 bond with an annual coupon payment of $50. This gives the bond a 10% yield ($50/$500). But if the bond price falls to $400, the yield increases to 12.5% ($50/$400). Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The price of each bond is calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Introduction. Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity.Hence, they trade at a deep discount. The bond pricing varies with time to maturity.. The higher the time until maturity, lower will be the price the investor will be willing to pay.

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond.

Coupon Bearing Bond Pricing using R code | R-bloggers This post explains how to calculate the price of some complicated coupon bearing bond using R code. Pricing of Coupon Bond using R code There are pricing formula for coupon bond as well as discount bond which are used among practioners under the market convention. Bond Pricing Formula Discount Bond P = F (1 + r)T(1 + r × D Y) P : price F

Accrued Interest Of Coupon Bond Quick and Easy Solution Bond Pricing Between Coupon Dates (Solved Example)(CFA... Debt Investments (Accrued Interest) Bond Basics Part 1 - calculate proceeds, entries for... Bond price calculation on the TI BA II Pus and... Junk Bonds and Taxes: The AHYDO Rules (U.S. Corporate... FRM: Day count conventions for bonds.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

Post a Comment for "38 price of coupon bond"