39 calculate price zero coupon bond

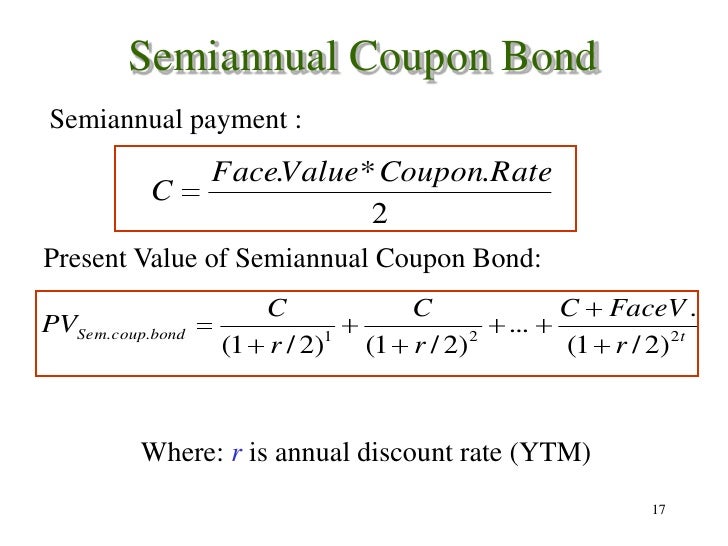

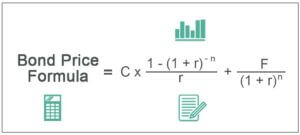

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Calculate price zero coupon bond

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples) Eurobonds - Definition, Regulations, How to Calculated In the workout, the compounded annual interest yield has been computed for each of the zero-coupon bonds. The formula for the same is: Compounded Interest Annual Interest Yield = (Face Value / Issue Price) ^ (1 / Years To Maturity) - 1 In Excel, there is a function known as 'Rate', through which this yield has been calculated in the workout.

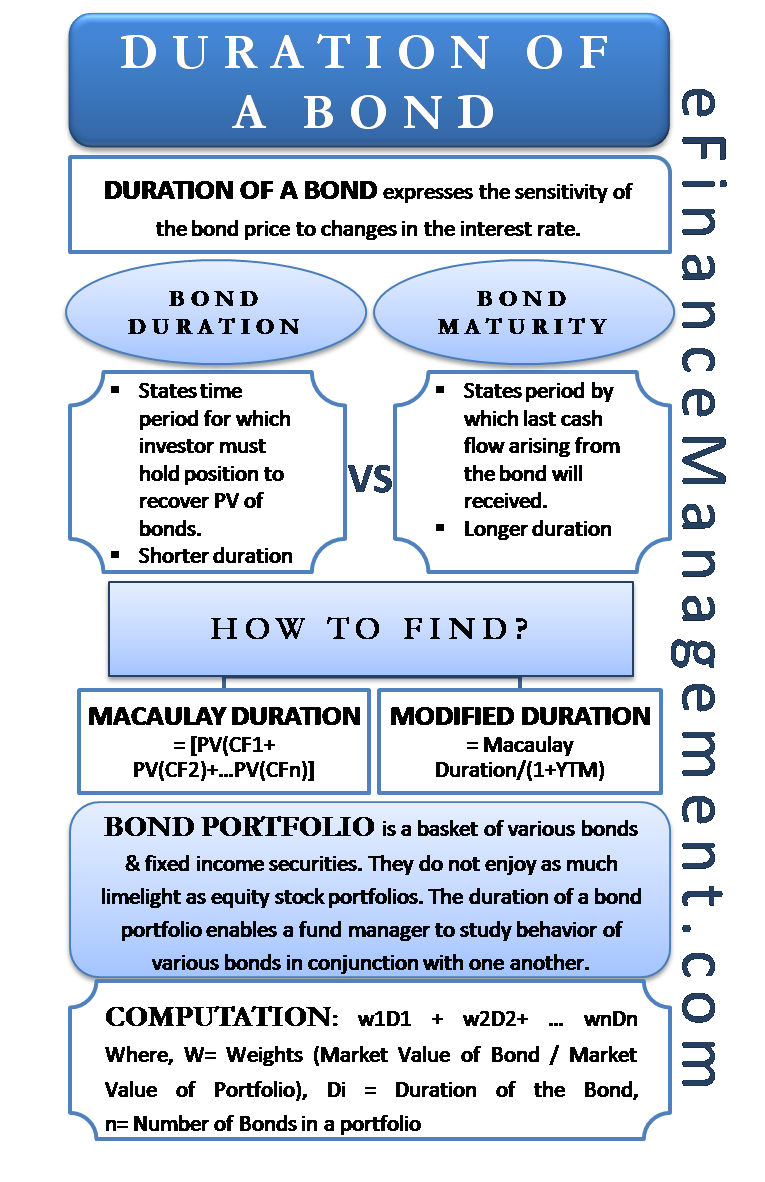

Calculate price zero coupon bond. What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. Additionally, since the bond matures in 2 years, then for ... What Is Dirty Price? - The Balance To calculate the dirty price, add the clean price and the accrued interest: Dirty price = $970 clean price + $4.16 accrued interest = $974.16 Each day that passes, an additional 13.88 cents of interest will accrue for Company ABC's bonds, which means the dirty price will increase by this amount daily. Dirty Price vs. Clean Price How to Calculate Yield to Call (YTC): Definition, Formula & Example P = price of the bond ; t = time in years remaining until the call date ; Let's say that Susan buys a bond for $950 that has a call price of $1,000 in two years. The bond has a 6% interest rate ...

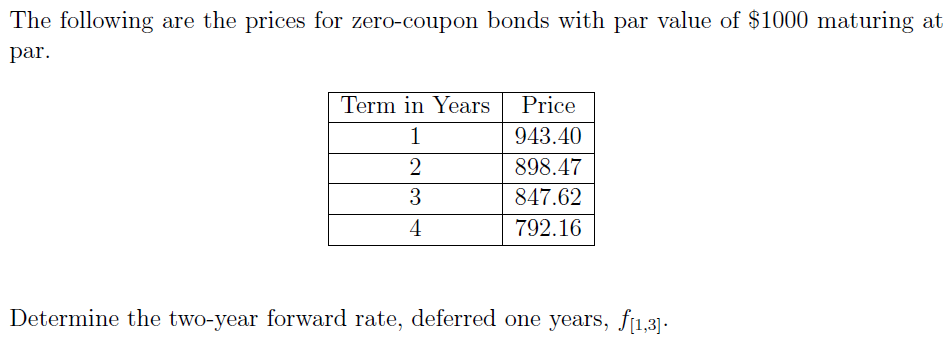

Zero Coupon Bonds: Calculating Price, Interest, and Value The bond has a coupon rate of 6.4%, pays interest annually, has a face value of $1,000, 4 years to maturity, and a yield to maturity of 7.2%. The bond's duration is 3.6481 years. You expect that interest rates will fall by .3% later today. * Use the modified duration to find the approximate percentage change in the bond's price. Spot And Forward Yields - Rate Return - Do Financial Blog The following is a list of prices for zero-coupon bonds of various maturities. Calculate the yields to maturity of each bond and the implied sequence of forward rates. Maturity (Years) Price of Bond ($) ... Suppose that the prices of zero-coupon bonds with various maturities are given in the following table. The face value of each bond is ... fixed income - How do you construct a zero coupon curve from the ... The yields at a tenor of 0.5 years calculated above is a zero-coupon rate and your starting point for bootstrapping the zero-coupon curve. We then use bootstrapping to construct the zero/spot curve. We use the interpolated yield for each tenor as the ANNUAL COUPON which defines the cash flows before maturity. Bond Pricing - Formula, How to Calculate a Bond's Price Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value Each bond must come with a par value that is repaid at maturity. Without the principal value, a bond would have no use. The principal value is to be repaid to the lender (the bond purchaser) by the borrower (the bond issuer).

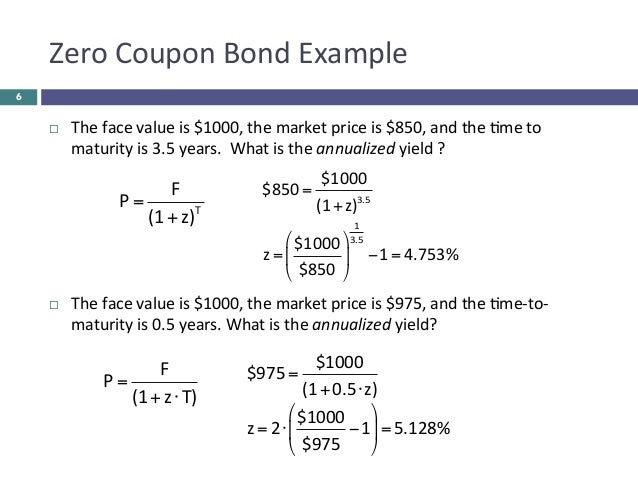

Quant Bonds - Between Coupon Dates - BetterSolutions.com The buyer compensates you for this by adding the accrued interest to the current price. This is the amount of the coupon payment that the holder of the bond has earned since the last coupon payment. SS - equation. Include only one of the two bracketing dates. If this is the first coupon, use the dates date instead of the previous coupon date. What Is a Zero Coupon Yield Curve? (with picture) The reason for constructing a zero coupon yield curve is for use as a basic tool in determining the price of many fixed income securities. A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Zero Coupon Bond Calculator The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

bond-pricing · PyPI This mode is particularly convenient to price par bonds or price other bonds on issue date or coupon dates. For example, finding the price of a 7 year 3.5% coupon bond if the prevailing yield is 3.65% is easier in this mode as the maturity is simply given as 7.0 instead of providing a maturity date and specifying today's date.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Essentially, when you buy a zero, you're getting the sum total of all the interest payments upfront, rolled into that initial discounted price. For example, a zero-coupon bond with a face value of...

Zero Coupon Bond | Definition, Formula & Examples - Study.com To calculate the current price or the present value of zero-coupon bonds, the formula for yearly stated discount rates is given as such: PV = M / ((1+i) ^ n) Where:

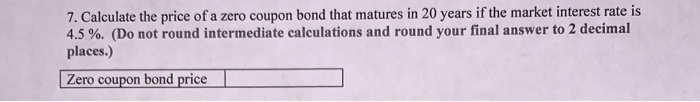

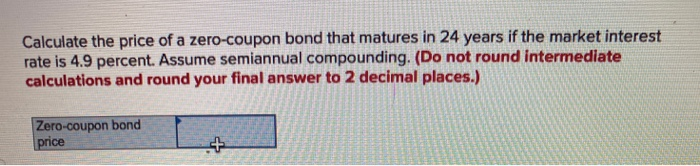

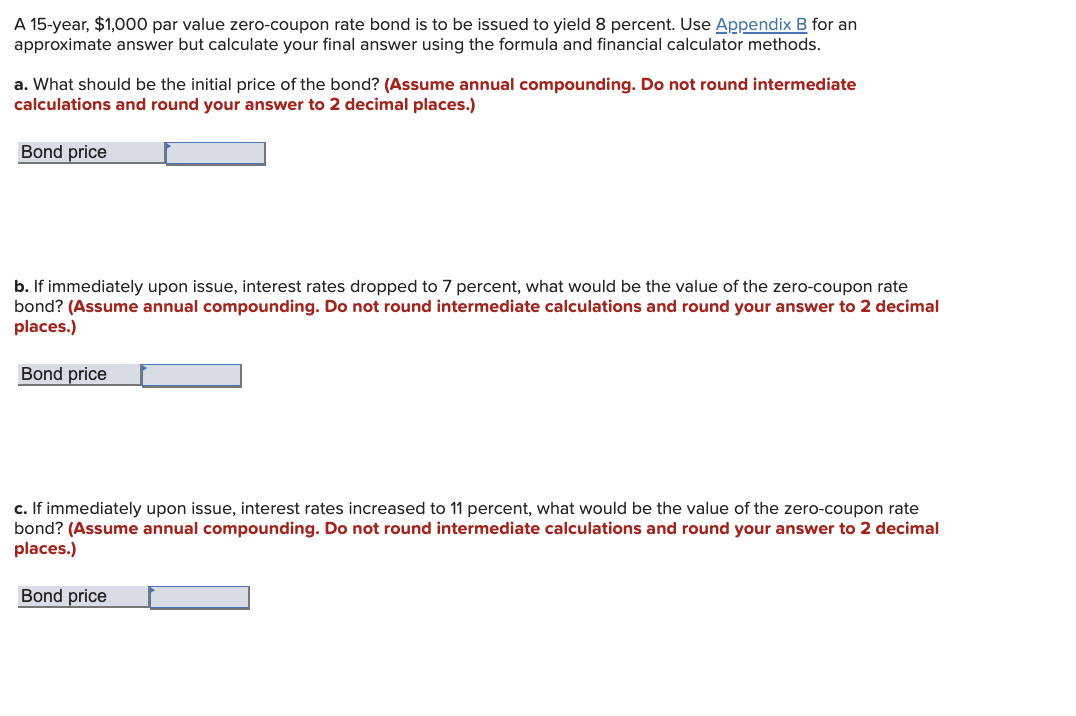

Quant Bonds - Zero Coupon - BetterSolutions.com What is the price of a zero coupon bond that matures in 10 years. 1) Calculate the number of periods To make this consistent with the equation for coupon paying bonds the number of periods will be (10 * 2) = 20. 2) Calculate the semi-annual interest rate the semi annual interest rate will be 8.6/2 = 4.3. bond price = 1000 / (1 + 0.043)20

Price of a Zero coupon bond - Calculator - Finance pointers The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face value / Maturity value of the zero coupon bond, Discount ...

Eurobonds - Definition, Regulations, How to Calculated In the workout, the compounded annual interest yield has been computed for each of the zero-coupon bonds. The formula for the same is: Compounded Interest Annual Interest Yield = (Face Value / Issue Price) ^ (1 / Years To Maturity) - 1 In Excel, there is a function known as 'Rate', through which this yield has been calculated in the workout.

How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples)

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Post a Comment for "39 calculate price zero coupon bond"