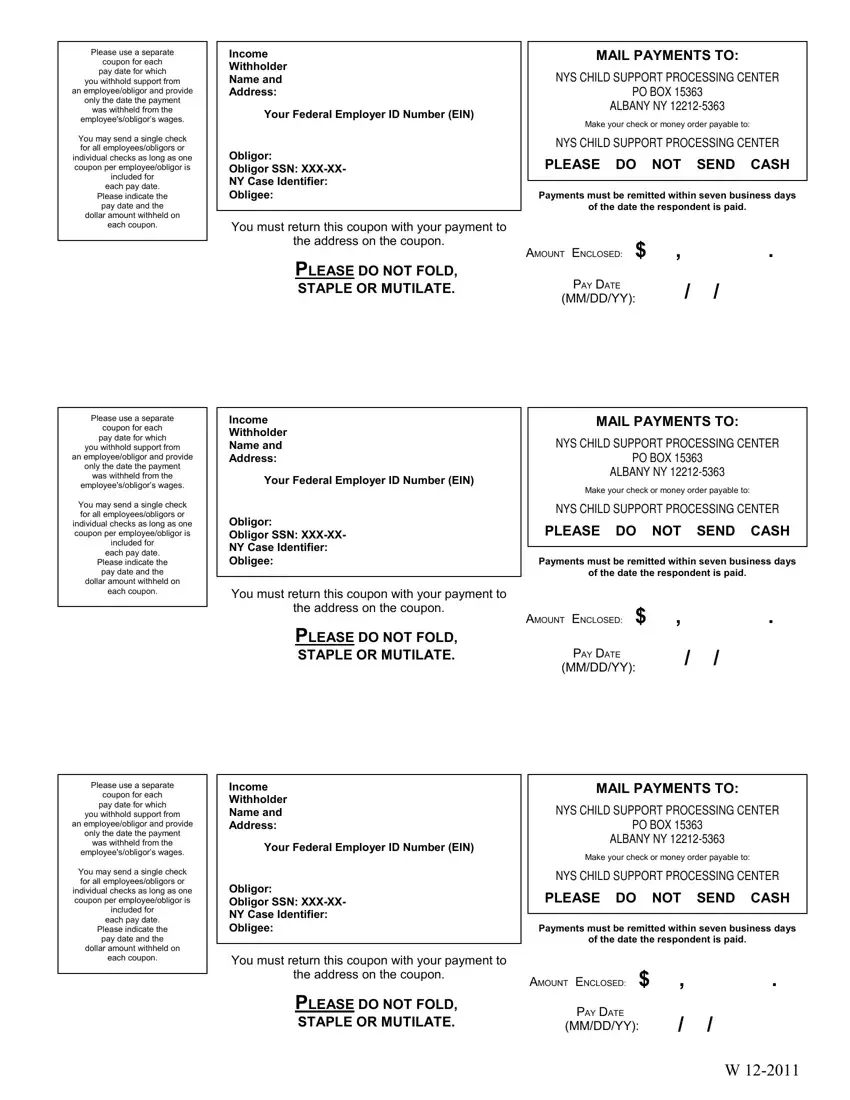

45 payment coupon for irs

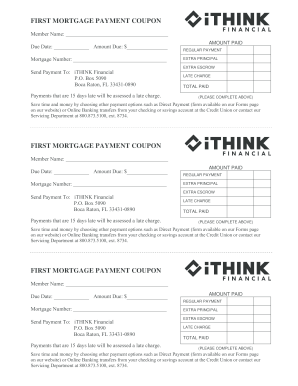

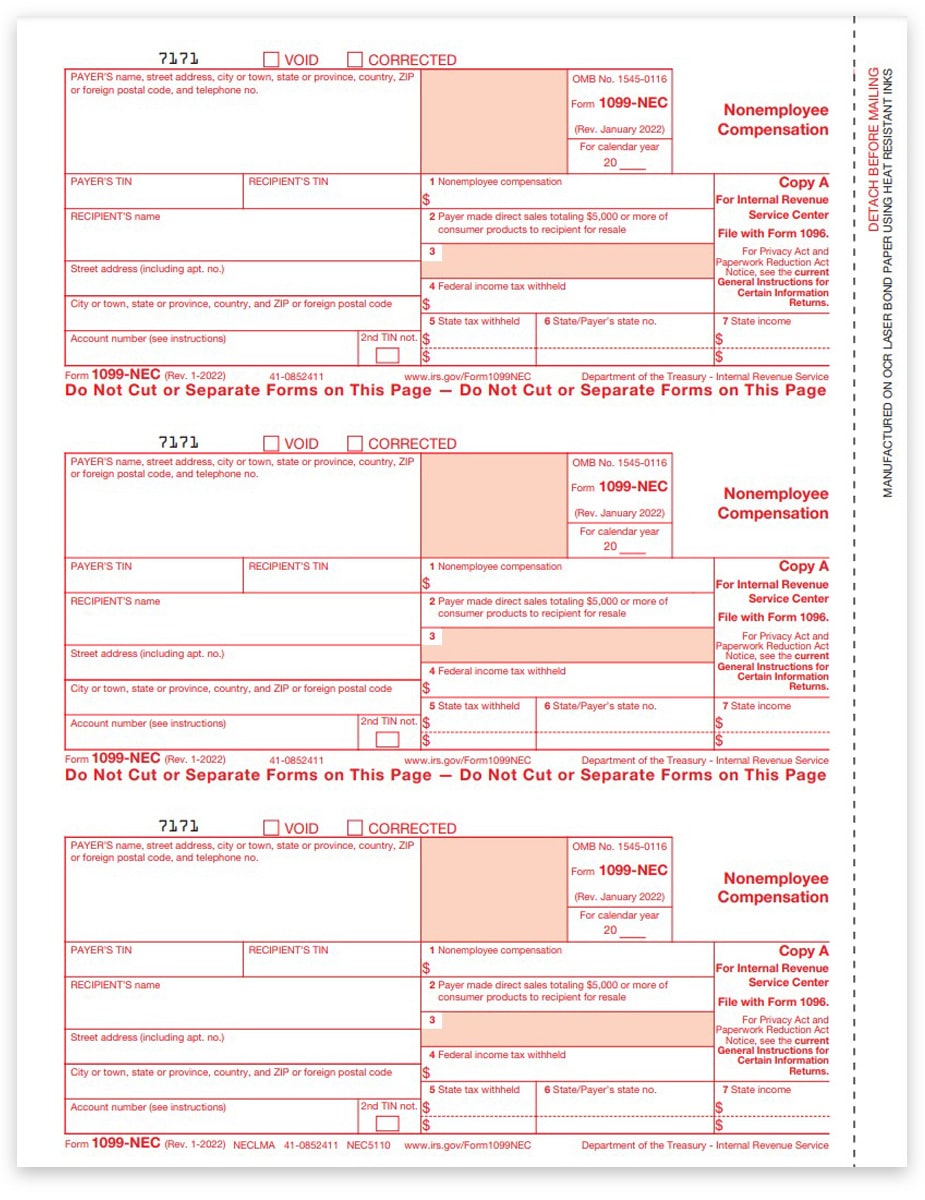

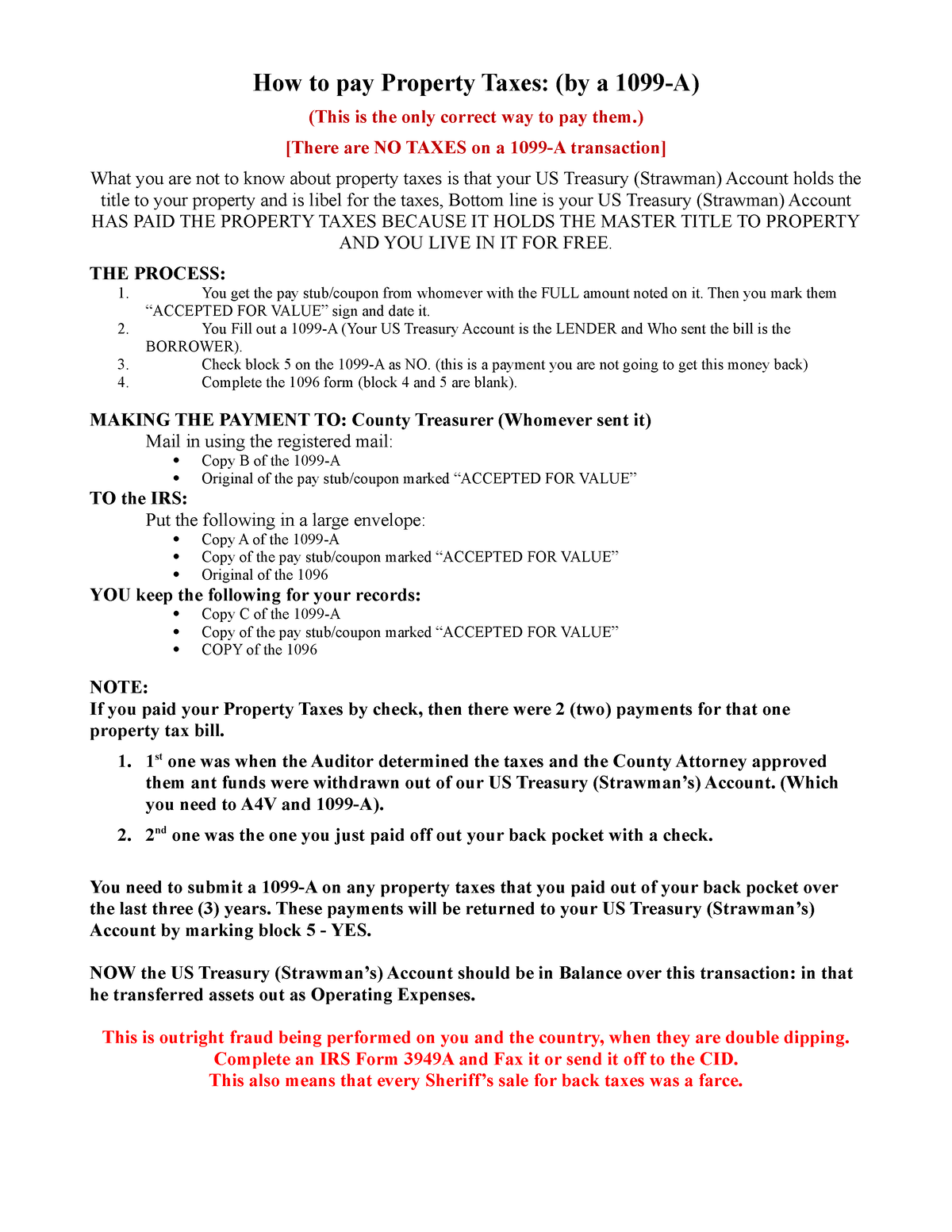

Payment Coupon Books, Payment Books - Bank-A-Count.com Payment coupon books are the easy way to collect payment from your customers. Books have a variety of features and can be customized to suit your individual needs. Choose from custom inserts, coupon formats, and more! All Bank-A-Count products are backed by an outstanding customer service team. Payment books feature: Affordable, competitive pricing How to Get Your Old IRS Forms W-2 and 1099 - H&R Block The IRS keeps a record of 36 types of information statements that it gets from third parties like your employer, financial institutions, and other people who pay you. Here are some examples: Forms W-2 for wages (W-2G for gambling winnings) Forms 1099 for other types of income (self-employment, investment, social security, pension, stock sales, etc.) Forms 1098 for certain …

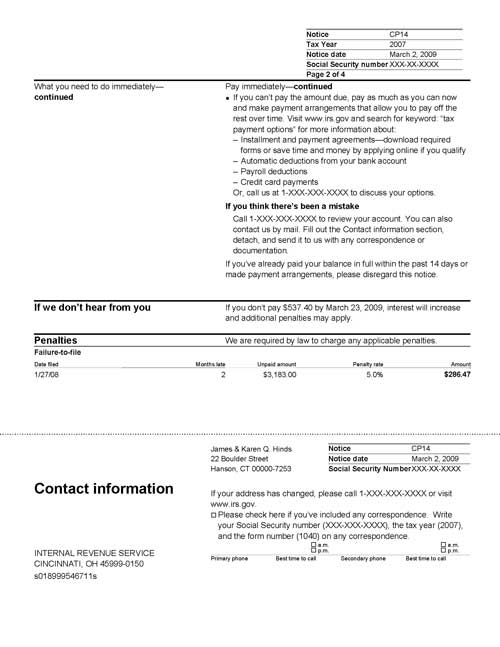

Confirm the IRS Received Your Payment | H&R Block If two weeks have gone by since you sent the last payment and your bank verifies that the check hasn’t cleared your account, call the IRS at 800-829-1040. Ask them if the payment has been credited to your account. If the IRS cash check processing your tax payment hasn’t been completed and your check hasn’t yet cleared, you can:

Payment coupon for irs

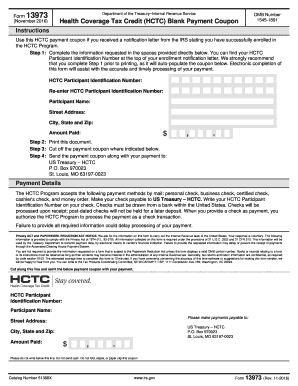

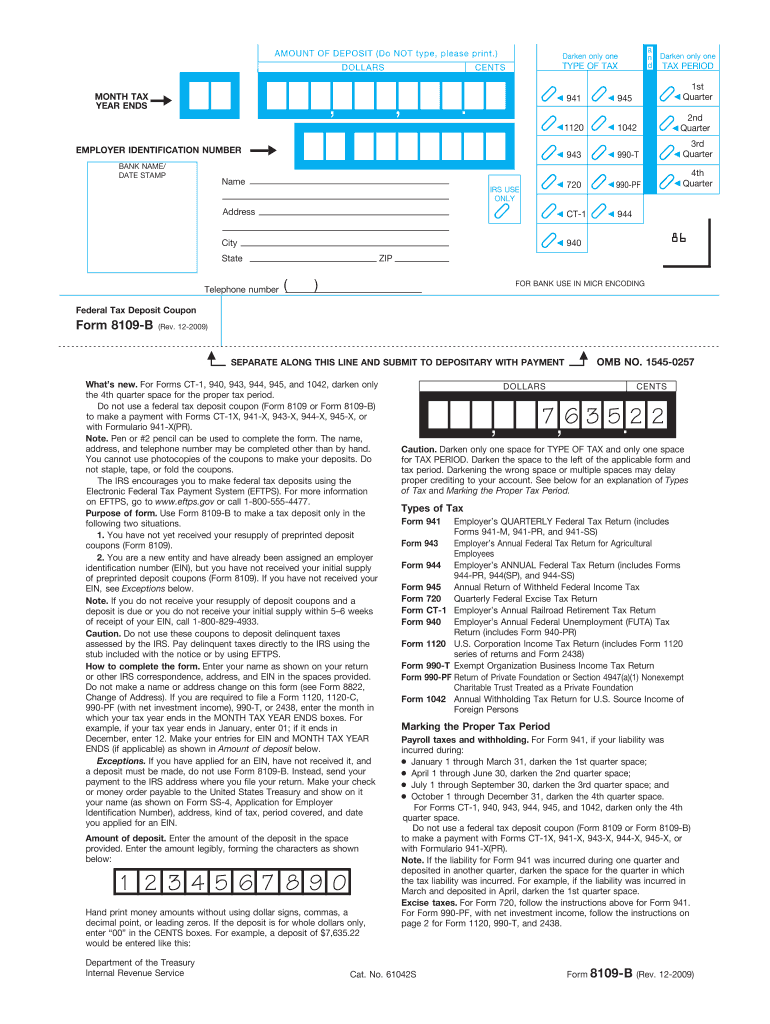

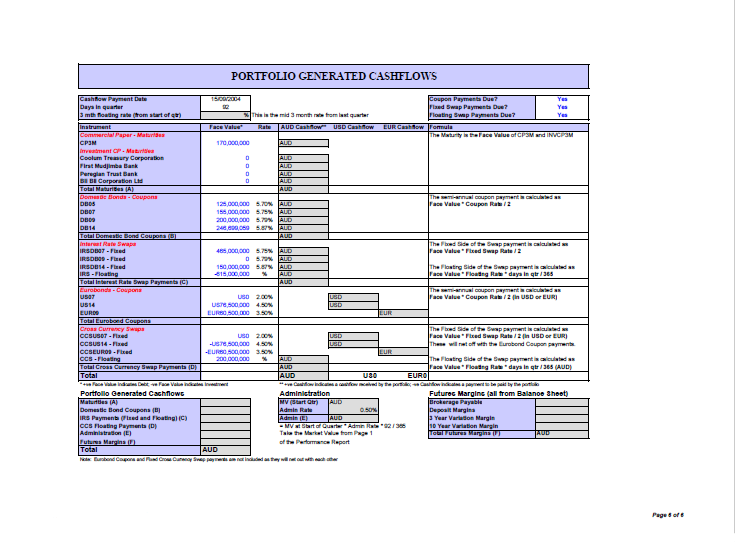

Payments | Internal Revenue Service - IRS tax forms Sep 21, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. File IRS Form 2290 Online (HVUT) | 2290 Tax | No Hidden Fee eform2290 is an IRS Authorized HVUT e-filing service provider. Use eform2290.com to file HVUT Tax, download Form 2290 Schedule 1 and file free VIN correction 2022 Form 1040-ES - IRS tax forms 1st payment..... April 18, 2022 2nd payment..... June 15, 2022 3rd payment..... Sept. 15, 2022 4th payment..... Jan. 17, 2023* * You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return. If you mail your payment and it is postmarked by the

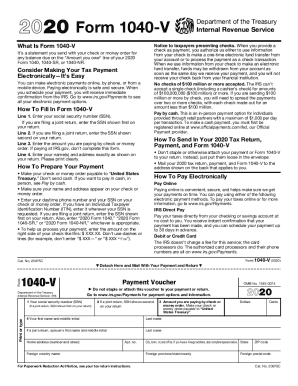

Payment coupon for irs. Still Waiting on Your Tax Refund? Now the IRS Owes You More … 18.07.2022 · From there, you'll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you've received from the IRS and your address on file ... About Form 1040-V, Payment Voucher - IRS tax forms Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR. 2022 Form 1040-ES - IRS tax forms 1st payment..... April 18, 2022 2nd payment..... June 15, 2022 3rd payment..... Sept. 15, 2022 4th payment..... Jan. 17, 2023* * You don’t have to make the payment due January 17, 2023, if you file your 2022 tax return by January 31, 2023, and pay the entire balance due with your return. If you mail your payment and it is postmarked by the File IRS Form 2290 Online (HVUT) | 2290 Tax | No Hidden Fee eform2290 is an IRS Authorized HVUT e-filing service provider. Use eform2290.com to file HVUT Tax, download Form 2290 Schedule 1 and file free VIN correction

Payments | Internal Revenue Service - IRS tax forms Sep 21, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

/1040-V-df038816cc244b248641f447493a030d.jpg)

/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "45 payment coupon for irs"