45 how to find the coupon payment

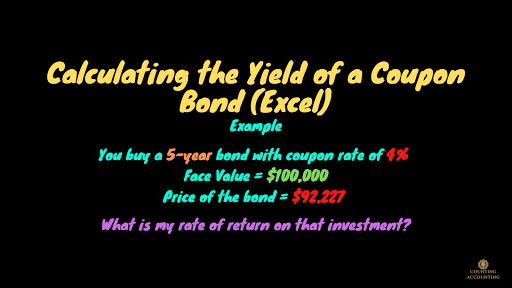

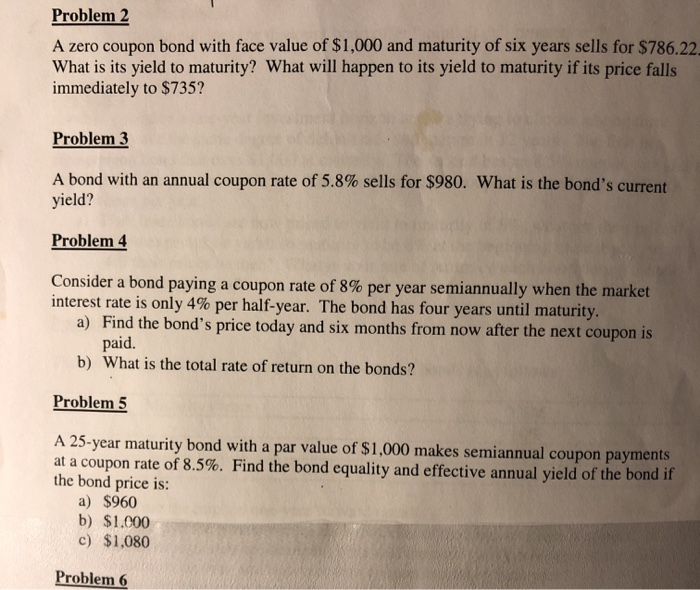

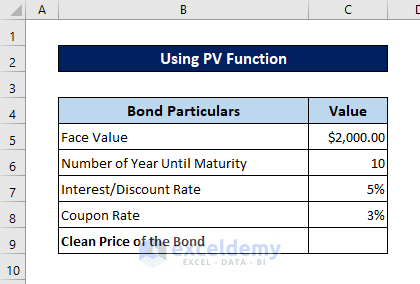

How To Calculate A Coupon Payment - Rent Sale Property The company files the necessary paperwork and holds a bond offering. Yield rate is a bond's rate of return relative to what an investor actually paid for the asset, not relative to its initial face value. For example, a bank might advertise its $1,000 bond with a $50 biannual coupon. How To Find Coupon Rate Of A Bond On Financial Calculator Enter the bond's coupon payment amount. Divide the coupon payment amount by the face value. Multiply the result by 100 to get the percentage. For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest ...

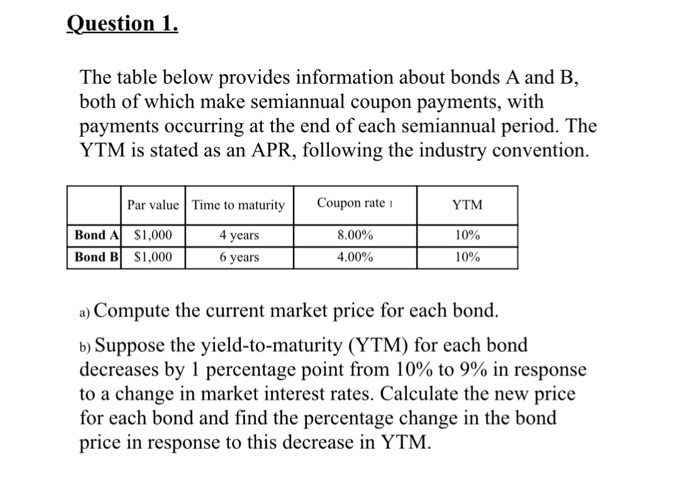

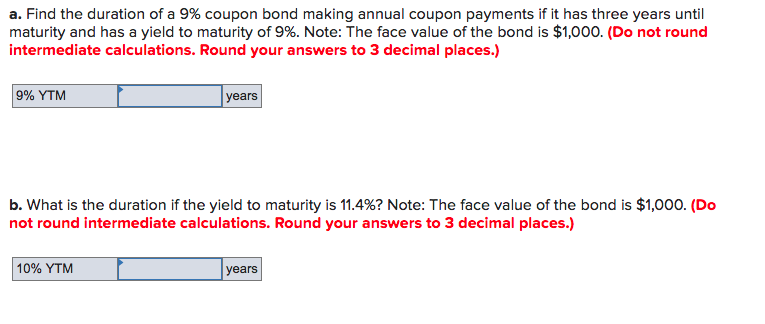

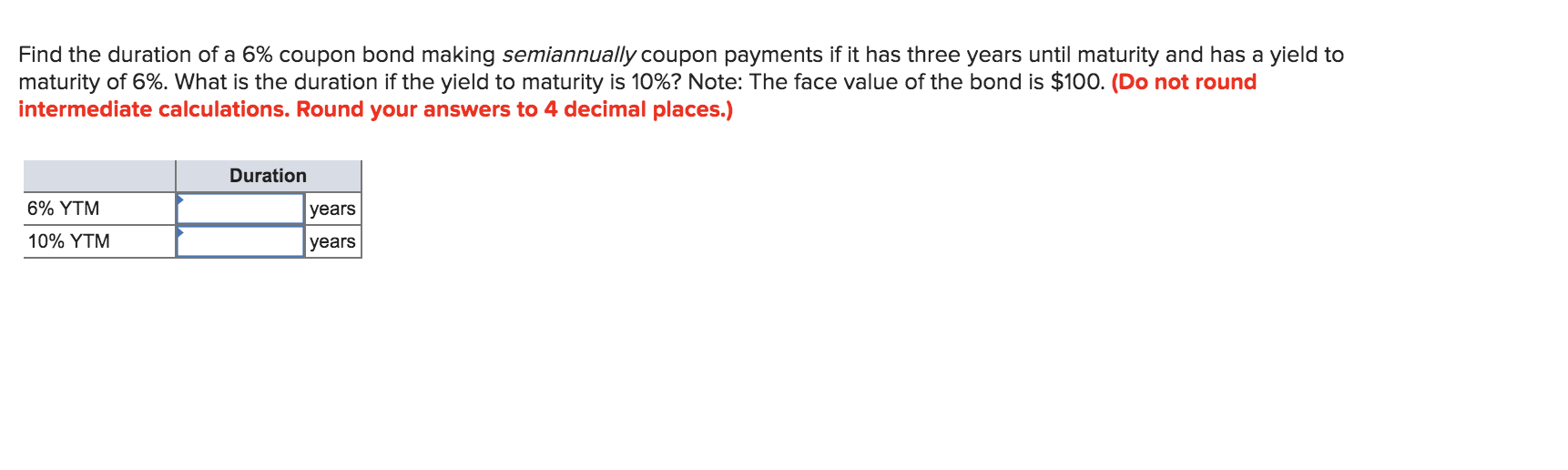

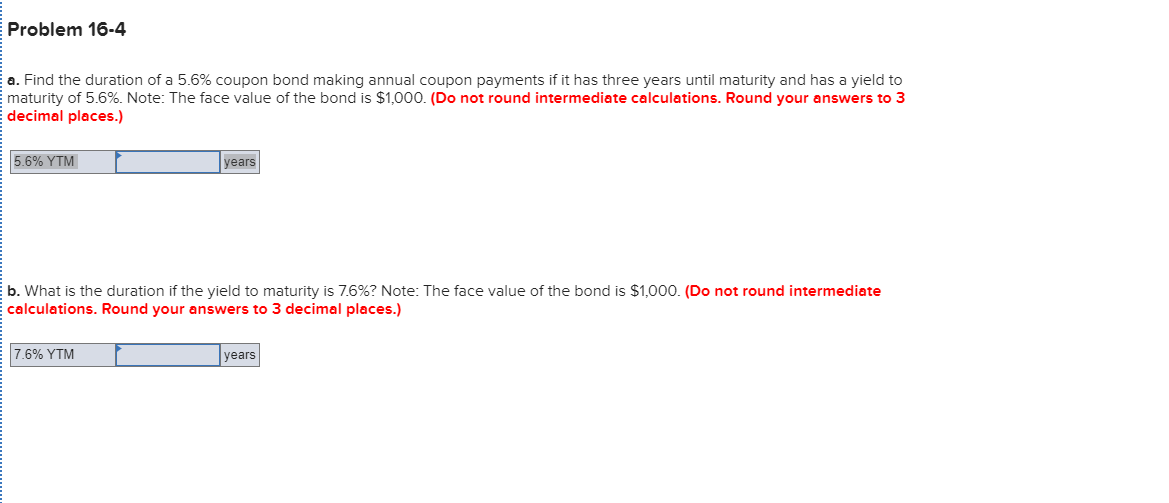

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ...

How to find the coupon payment

How to Calculate a Coupon Payment - Stand 4 Aids Investors must know how to calculate the coupon bond payment to understand coupon finance. The formula is simple to understand, as explained in the example below. However, avoiding this is possible in three ways - buying municipal zero-coupon bonds, buying them in a tax-exempt account, or buying corporate zero-coupon bonds with tax-exempt status. Coupon Bond Formula | Examples with Excel Template - EDUCBA Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ... Coupon Payment | Investor.gov Coupon Payment. The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value. Featured Content. World Investor Week - Investing Quiz. Test your knowledge of crypto assets, diversification, ESG investing, and other key topics from WIW 2022!

How to find the coupon payment. How to Calculate the Price of Coupon Bond? - WallStreetMojo What is Coupon Bond Formula? The term " coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more " refers to bonds that pay coupons which is a nominal percentage of the par value or ... Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50. With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

How to Calculate a Coupon Payment | Sapling In finance, a coupon payment represents the interest that's paid on a fixed-income security such as a bond. Par value is the face value of a bond. Calculate the annual coupon rate by figuring the annual coupon payment, dividing this amount by the par value and multiplying by 100 percent. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued. How to Calculate Coupon Rate in Excel (3 Ideal Examples) 2. Calculate Coupon Rate with Monthly Interest in Excel. In the following example, we will calculate the coupon rate with monthly interest in Excel. This is pretty much the same as the previous example but with a basic change. Monthly interest means you need to pay the interest amount each month in a year. So, the number of payments becomes 12 ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ... How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or ... Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as ... Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

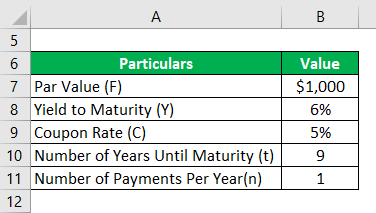

Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%.

Coupon Payment | Investor.gov Coupon Payment. The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value. Featured Content. World Investor Week - Investing Quiz. Test your knowledge of crypto assets, diversification, ESG investing, and other key topics from WIW 2022!

Coupon Bond Formula | Examples with Excel Template - EDUCBA Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

How to Calculate a Coupon Payment - Stand 4 Aids Investors must know how to calculate the coupon bond payment to understand coupon finance. The formula is simple to understand, as explained in the example below. However, avoiding this is possible in three ways - buying municipal zero-coupon bonds, buying them in a tax-exempt account, or buying corporate zero-coupon bonds with tax-exempt status.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 how to find the coupon payment"